Did you know that insurance isn't just a safety net, but a strategy employed by billion-dollar industries to maximize profits? It's time to unravel its complex web.

As we face unprecedented economic shifts, understanding insurance has never been more crucial. Discover how this hidden powerhouse impacts your life daily.

It's something most people overlook, but insurance isn't just about protection. Its mechanisms can be strangely lucrative for those in the know. While most struggle to grasp policy fine print, insiders are reaping rewards. They understand the secretive core of it all. But that’s not even the wildest part…

For decades, insurance remained a dull topic to many, overshadowed by its dull reputation. Yet, behind the curtain, there's a rapidly evolving landscape. New technologies are shaking matters up, making traditional models obsolete. Ironically, these changes could mean huge savings for you. What happens next shocked even the experts...

Insurance is more than just premiums and policies—it's an entire industry driven by complex power dynamics. While it might appear straightforward, the influence insurance companies wield can be enormous. They aren't just providers; they're major players in the financial world. Yet, many consumers remain in the dark about these networks. Surprisingly, this is by design. But there's one more twist...

An often-overlooked fact: Insurance companies make massive portions of their profits by investing the premiums you pay. This investment strategy empowers these companies to influence markets and even political landscapes. You're not just a policyholder; you're a small part in a much bigger financial game. The implications can be startling. What you read next might change how you see this forever.

The innovation doesn’t stop there. With developments in technology, insurance firms are adopting AI and machine learning to predict risks with startling accuracy. This adaptation is reshaping risk assessment, making policies more personalized than ever. But how exactly does this personalization impact you? More surprising details lie ahead...

You’ve likely experienced frustrating customer service from insurance providers. Yet, behind-the-scenes improvements are in motion. Through automation, inquiries and claims can be processed faster, benefitting customers and trimming costs. But, are these savings truly passed on to you? Discover the unexpected truths about policyholder advantages just around the corner...

The traditional one-size-fits-all insurance policy is becoming obsolete. Companies are shifting to data-driven personalized approaches that promise not just relevance, but better value for policyholders. But this move raises a question: How much of your personal information are they actually using to tailor these contracts? The answer may surprise you.

Collecting data from a variety of sources, including your online behavior, social media, and even wearable devices, insurers can now paint a comprehensive picture of you. This data allows for customization like never before, but comes with its own set of privacy concerns. How safe is your information? What you read next can change how you see your digital footprint.

With personalized insurance comes the promise of more accurate assessments and potentially lower premiums. More fair rates based on personal data rather than general demographics could benefit you significantly. However, it could also lead to higher costs for those in high-risk brackets. The stakes have never been higher, and there's more at play than meets the eye.

While the perks of personalization are tempting, the risks to personal data security are real. Breaches in personal data could expose vulnerable information, turning a safety measure into a liability. Is the trade-off worth it? Dive deeper into the double-edged sword of personalized policies.

Insurance isn't just a safety mechanism on an individual level; it's pivotal to global economic stability. Its reach extends beyond just customers, playing a crucial role in stabilizing markets and providing safety nets for governments and businesses alike. In fact, many infrastructures rely on insurance to maintain their foundational security. But here’s where it takes an unexpected turn...

Few realize that insurance companies, acting as large institutional investors, significantly contribute to economic fluctuations. When they move money, markets shiver with anticipation—or dread. This unspoken influence often goes unnoticed by everyday policyholders who remain unaware of the stakes involved. Could your premium payments be nudging economic trends?

The alliance between governments and insurers is particularly fascinating. In times of crisis, private insurance firms often partner with the public sector to manage financial risk, supporting public wealth and resources. These partnerships are vital not only for recovery but for strategic growth in many regions. Yet, such entanglements raise pressing questions about accountability and control.

Despite its integral role, the tightrope insurance walks along with global economies is precarious. Economic turmoil can lead to abrupt policy changes, affecting millions worldwide overnight. The results of these shifts can range from beneficial to devastating. Are you prepared for potential ripples in your world? Stay tuned to unravel more...

The insurance industry's digital transformation is nothing short of revolutionary. From blockchain to AI, technology is redefining every aspect of how insurance operates. This shift towards digital not only enhances efficiency but opens a world of opportunity for both companies and consumers. Yet, not all changes are as beneficial as they seem. Here's the startling detail...

Blockchain technology introduces transparency and trustworthiness into insurance processes like never before. By offering immutable records, it cuts down on fraudulent claims, saving billions for companies and customers alike. The real question, though, is at what pace will this technological advancement be accepted across industries? The following details might shock you.

AI and predictive analytics are streamlining claims processing, transforming a once tedious task into a quick and efficient process. This transformation means faster payouts for you or denial of claims in record time. But what happens when machines make these decisions? The implications for customer service and satisfaction are profound and sometimes alarming.

While innovation is often associated with progress, the transition to digital insurance poses significant challenges. Cybersecurity threats remain a major concern, risking breaches of sensitive data. This digital vulnerability makes safeguarding information more critical than ever. How effective are current protective measures, and what’s on the horizon? Discover these future strategies next...

In crisis scenarios, whether natural disasters or economic downturns, insurance steps in as a lifeline. Not only for individuals but for entire communities and nations. The role insurance plays becomes indispensable, guiding recovery and providing much-needed support. But is it all as rosy as it sounds?

During calamities, like hurricanes and wildfires, insurance companies face unprecedented pressure to fulfill numerous claims. This process can both make and break companies—testing their liquidity and resilience. Yet, despite these challenges, some firms emerge stronger, while others falter. What exactly determines these outcomes? The dynamics are more complex than they appear.

Government intervention during crises often sees insurance used as a tool for economic recovery. Public insurance schemes are established to offset catastrophic losses, ensuring stability. However, this involvement can sometimes lead to questions of fairness and efficiency—a debate as old as the industry itself. How fair is the distribution of aid in times of need?

Even amidst adversity, there are stories of resilience and innovation where the insurance industry has pivoted to find solutions that benefit all stakeholders. Collaborative efforts have led to surprising alliances between insurance giants and small startups aiming to rebuild stronger systems. Are these collaborations the future? Prepare to uncover the unexpected partnerships shaping tomorrow.

Forget life, auto, or homeowner’s insurance—there’s a world of bizarre policies out there, each more absurd than the last. Ever considered alien abduction insurance? Or perhaps a policy for a lottery win? Welcome to the realm where imagination meets risk mitigation. You won’t believe the peculiarities you’re about to discover...

In the quirky realm of unusual insurance, policies guard against near-impossible events. Companies offer protection for unexpected scenarios, from weather insurance for weddings to taste bud insurance for top chefs. These plans, though unconventional, reflect the creativity and vast potential within the sector. Curious about the costs these bizarre plans entail?

Celebrities and high earners often insure their most valuable assets: body parts. From soccer stars with insured legs to musicians protecting their voices, these bespoke policies reveal the personal value placed on talents and abilities. It's not just vanity; it’s big business. How much is a leg worth? The figures might just floor you.

These outlandish policies aren't just for kicks. They demonstrate the insurance industry’s flexibility and its ability to adapt to niche markets. Behind the unusual is a thriving enterprise catering to specialized needs. Ever pondered what triggers the creation of such policies? There’s more than just a market demand at play—unravel the hidden motives next.

Underinsurance might be the silent threat lurking in your financial plans. Many assume they’re adequately covered, unaware of glaring gaps. An accident or disaster can leave even the seemingly insured grappling with devastating costs. Have you considered what’s truly in your policy? What lies beneath the surface may surprise you.

Policyholders often overlook the intricate details and limitations written in fine print. These clauses can result in significant shortfalls when it’s time to claim. This underinsurance results in wide coverage gaps, leaving individuals vulnerable. But how do you effectively bridge these gaps? The upcoming scenarios offer valuable insights into prevention tactics.

Widespread underinsurance doesn't just affect individuals. It's a systemic issue that can threaten entire economic regions during crises. Inadequate insurance coverage can cause widespread financial turbulence, affecting not just private parties but public resources and infrastructure. How widespread is the threat in your community?

Increasing awareness about adequate coverage is crucial. Tools and resources are emerging, offering comprehensive evaluations of existing policies to spotlight potential shortfalls. Knowing where you stand financially when it comes to insurance can be a game-changer. Are you prepared to identify your coverage gaps? Uncover practical tools that can assist in our next discussion.

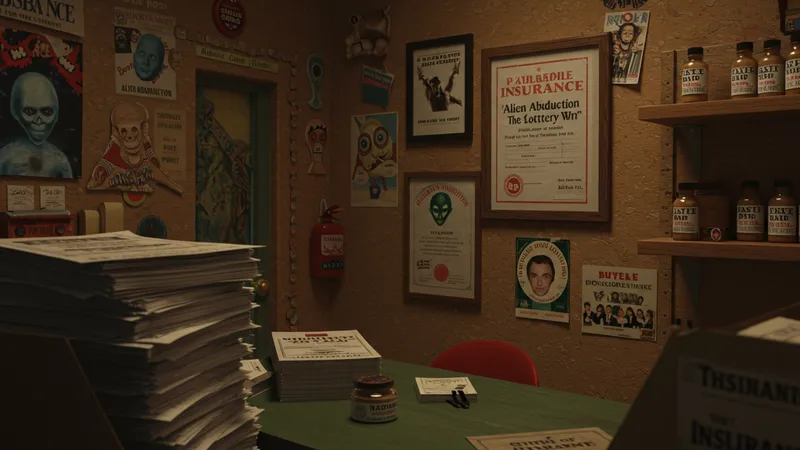

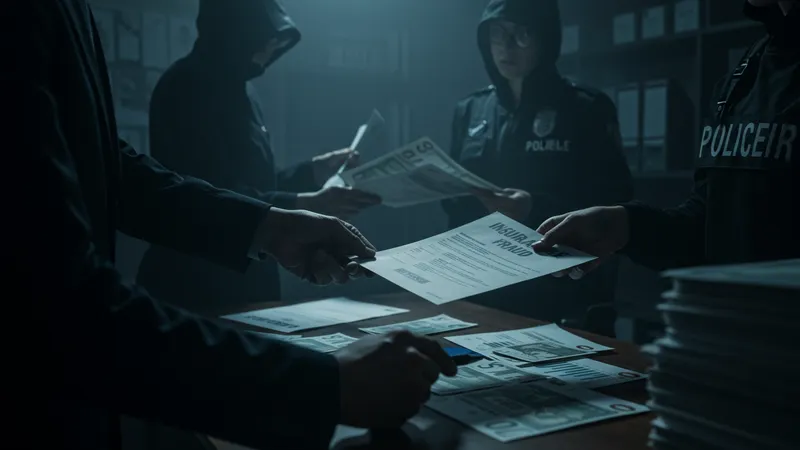

Insurance fraud is the industry’s hidden nemesis, lurking in the shadows with significant financial ramifications. It's a crime that burdens the sincere policyholder with additional costs and complexities. Just how pervasive is this menace, and who are the perpetrators behind these deceptions?

While most expect fraud to be an outsider's game, its tentacles can reach deep within the industry itself. Agents and insiders sometimes orchestrate elaborate schemes to falsify claims, resulting in millions of dollars lost each year. How are these crimes executed, and more importantly, what measures are in place to combat them?

The consequences for the average policyholder are profound when fraud is involved. Premiums increase and claims processes become more stringent, leading to a loss of faith in the system meant to protect you. But how does one stay vigilant and protect their interests amidst such pervasive deceit?

Fortunately, innovation is stepping in. AI and big data analytics are empowering the insurance sector to detect fraudulent activities with precision and speed. With continuous advancements, the industry is finding new ways to safeguard against these malicious acts. Are these technologies effective enough to make a difference? Discover cutting-edge fraud prevention strategies in the next segment.

As climate change accelerates, its impacts on the insurance industry grow exponentially. Increasing natural disasters are forcing companies to adjust, often resulting in skyrocketing premiums and coverage limitations. How severe is the climate crisis's impact on your insurance? Unravel the indicators you can't ignore.

Insurance companies must constantly reevaluate risk as weather patterns become more unpredictable. This volatility challenges traditional models of risk assessment and urges companies to reinvent their strategies to maintain viability. But does this reactionary stance jeopardize policyholder security in the wake of disasters?

A burgeoning need for climate-oriented policies is prompting insurers to devise innovative products aimed at covering unique risks posed by climate change. These solutions range from more comprehensive flood insurance to carbon offsetting initiatives. But how accessible are these to the everyday consumer, and what barriers remain?

The industry faces a critical point where adaptability meets accountability. Insurers play a pivotal role in not only aiding recovery efforts but championing proactive measures for sustainability. Will their influence be a catalyst for global environmental change? The discussion ahead examines the potential influence of powerful insurers.

Ever skimmed over your insurance documents? You’re not alone. The legal jargon and fine print within policies can be daunting even for the discerning reader, yet crucial to understand. Unpacking these complexities might seem tedious, but it's worth every moment spent. Ready to delve into this intricate web?

Policies are laden with terms and conditions that dictate varying levels of protection. Misinterpretations can lead to denied claims exactly when intervention is necessary. This conundrum often leaves policyholders helpless at their most vulnerable moments. So, how can you fully grasp what’s covered and what’s not?

A rise in policy literacy is driving change, encouraging a shift toward greater transparency. There's a growing call for simplified documentation and more explicit communication between insurers and insureds. Could this movement redefine the standard in insurance policy formats nationwide?

Accessing the right resources and support, from knowledgeable agents to digital tools, empowers policyholders with clarity. Understanding your policy can directly impact your peace of mind and financial resilience. Ready to take control of your insurance literacy? Explore the avenues available in the next segment.

The insurance industry is on the brink of significant evolution. Technological advances, environmental challenges, and shifting consumer demands all shape a future that promises to look starkly different from today. What advancements should one anticipate in this ever-evolving sector?

Emerging technologies continue to disrupt traditional practices, propelling innovation in policy models and customer interactions. These changes target efficient risk assessment and personalized solutions unlike any seen before. But are they sustainable, and can they address the most pressing needs?

Consumer expectations are evolving rapidly, with increased demands for transparency, efficiency, and socially responsible practices. The modern policyholder expects more than just a contract—they want to trust their insurers’ commitment to greater causes. Are companies prepared to meet these heightened standards, and what does this mean for potential regulatory changes?

Insurance is positioned to become intertwined with everyday life experiences, affecting how we choose to protect our future, engage with providers, and even influence environmental policies. This digital transformation raises anticipation, but also hesitations. Are these changes ready to take us into a new era of insurance utilization?

The intricate journey through the world of insurance reveals both the ordinary and the extraordinary. As we dissected facets like personalization and fraud, its influence on economies, and the environmental push, one compelling truth emerged: insurance is far more than money or protection. It’s a reflection of our society's values and priorities.

Sharing this knowledge can empower others, fostering awareness and informed decision-making. Bookmark this guide, pass it along, or dive deeper into areas of interest. Insurance is a living, breathing element in our lives that's constantly growing and adjusting to our needs. Take action now to master its complexities and harness its full potential.